30/01/2024

Digital Public Infrastructure (DPI) refers to the framework of open-source software that forms a network-enabled to deliver services in the public interest. DPIs enable governments to deliver services, subsidies, and benefits to citizens, digitally transforming public service delivery. It allows people to establish identity, open bank accounts, make digital payments, and so on.

India’s adoption of a DPI-centric (Digital Public Infrastructure) strategy has yielded remarkable results, achieving an impressive 80% financial inclusion within just six years. This contrasts significantly with the projected 46 years required without a DPI-centric approach.

In this article, we will explore the identity layer of digital public infrastructure and India’s implementation of it with the largest biometric identity program in the world – Aadhar. The tremendous social impact created by its implementation is a template for the rest of the world on the potential of digital public infrastructure.

What is Aadhar?

Aadhaar, which translates to “foundation” in various Indian languages, stands as the largest biometric identity initiative globally. Launched in 2009, it has successfully registered nearly 1.2 billion Indian citizens and residents, constituting about 15% of the global population, with over 99% coverage of Indian adults. It plays a crucial role in India’s digital public infrastructure.

Every Aadhaar recipient is assigned a distinct 12-digit ID number and provides their photograph along with biometric data, including fingerprints and iris scans. Initially devised to combat fraud, waste, and misuse in social benefit programs by ensuring the correct distribution of benefits, Aadhaar has evolved to impact various aspects of daily life in India, such as banking transactions and mobile phone activation. Increasingly, participation in numerous programs mandates the use of Aadhaar.

Digital Public Infrastructure Case Study: The Problems with Welfare Distribution

Before the introduction of Aadhaar, India faced significant challenges in identifying beneficiaries for social programs. A substantial number of residents lacked formal identity credentials, and those who possessed such credentials often had ones that were only locally recognized. The absence of comprehensive identity records and effective verification processes led to government agencies frequently distributing social welfare benefits either multiple times to the same individuals or to those who did not meet the eligibility criteria. Preceding the implementation of Aadhaar, it was estimated that 58% of subsidized food grains and 38% of subsidized kerosene distributed through government programs did not reach the intended beneficiaries, resulting in significant resource wastage. These issues also impacted other social programs, including scholarships, healthcare, pensions, and subsidized household goods. Notably, some eligible households were deprived of social assistance they qualified for because proving their identity was a challenging task.

Digital Public Infrastructure Case Study: How Aadhar Changed Welfare Distribution

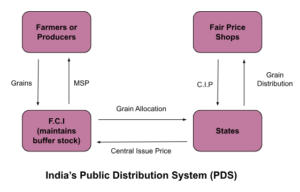

To address these challenges, the Indian government initiated Aadhaar, an ambitious program aiming to assign a unique digital identity, based on biometric information such as thumbprints and iris scans, to every individual in India, irrespective of age or gender. This biometric identification simplifies the verification process, ensuring that subsidized goods reach the intended recipients and minimizing the potential for fraudulent activities. Initially focusing on the Public Distribution System (PDS), a government-subsidized initiative aimed at improving food security for the 330 million nutritionally vulnerable Indians, Aadhaar targeted the largest distribution network of its kind globally, involving over 500,000 “fair price shops.”

The primary obstacle faced by the government was the widespread pilferage and diversion of food grains meant for low-income beneficiaries in the PDS. Before the introduction of Aadhaar, pilferage could occur through various means:

- Manual recording of sales records made it challenging to ascertain whether a sale occurred, if food was fraudulently diverted by Fair Price Shop (FPS) staff, or if the staff overcharged for provisions.

- Individuals obtained fake ration cards by creating fictitious families.

- Individuals utilized authentic ration cards, either stolen or purchased from others.

Aadhaar plays a crucial role in resolving these challenges by facilitating end-to-end digitization of distribution and sales procedures. The risk of diversion during transport and delivery to fair price shops is reduced through Aadhaar-enabled automatic weighing of rations, directly linked to the current handler’s Aadhaar identity. Inaccurate weight prevents the transfer of goods, and the handler’s identity is readily identifiable. To counter misuse at the beneficiary end, each fair price shop is equipped with digital point-of-sale devices. Shop employees use these devices to authenticate beneficiaries through fingerprints or iris scans, connecting to the Aadhaar database via mobile, Wi-Fi, or cabled internet. This ensures verification of the beneficiary’s identity and eligibility. Cashless payments through Aadhaar are employed for transactions, preventing physical exchange of money and averting customer overcharging. Rations are weighed to guarantee the correct amount for the beneficiary, and the shop cannot dispense benefits to ineligible individuals or those who have already received their ration, or if the weight is incorrect.

In some states, disabled beneficiaries are authenticated, and rations are delivered directly to their homes, while in others, a designated relative or neighbor can collect the rations. Furthermore, Aadhaar enhances efficiency by enabling the government to monitor the real-time inventories of each Fair Price Shop (FPS). This allows for timely replenishment of inventory, reducing the likelihood of shops operating black markets with excess stock, as was previously common.

Besides curbing fraud in the Public Distribution System (PDS), Aadhaar’s efficient and automated system offers beneficiaries the following advantages:

- Instead of physically checking the shop repeatedly, beneficiaries receive SMS messages notifying them of the availability of new supplies.

- Beneficiaries can access a mobile app that displays a map of all stores and their current inventory levels.

- Authentication of identity is instantaneous, reducing in-store wait times from half a day to a matter of minutes for collecting benefits.

- Beneficiaries have the flexibility to choose the shop where they prefer to receive their benefits. A centralized database manages benefits, allowing authentication at any location, thereby promoting choice and mobility.

Conclusion

Expanding beyond social services like PDS, Aadhaar now encompasses over 3,500 government and non-government services in India. These services include activities such as opening bank accounts, making digital payments, enrolling in school, activating a mobile phone, receiving pension payments, filing taxes, participating in voting, and making electronic signatures. Additionally, the government has introduced DigiLocker, a platform facilitating the issuance, sharing, and verification of documents and certificates, as part of an initiative to transition towards a paperless society.

Government officials anticipate that the complete capabilities of Aadhaar have yet to be fully realized, and they foresee the next phase of innovation emerging from the private sector, where businesses leverage Aadhaar as a foundational platform. The system incorporates an open application programming interface (API), enabling private sector companies to develop services utilizing Aadhaar identity management as a basis. This has the potential to create an entire ecosystem of applications. For instance, Google’s Tez app facilitates instant digital payments to friends, relatives, and businesses, attracting 7.5 million users within its initial five weeks and significantly boosting Aadhaar transactions.

Given its open interface, the creator of Aadhaar envisions a future where people employ Aadhaar in ways that are currently unimaginable.

Technoforte is an IT services and solutions company working in various industry verticals since two decades. Read about our IT staff augmentation services here!